A Robust Recovery: South Africa Major Banks Analysis - September 2022

By PwC

South Africa’s major banks deliver strong financial performance against complex conditions, underpinned by a disciplined focus on strategy execution.

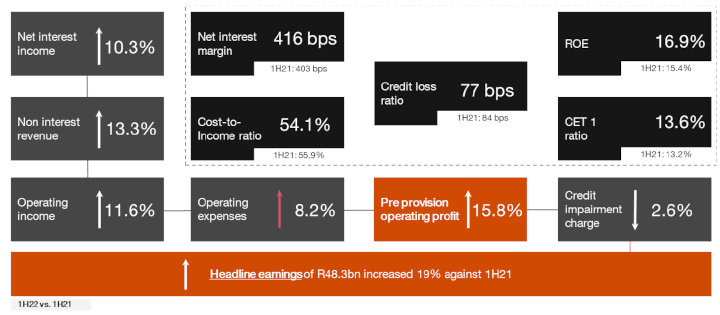

Combined headline earnings of R48.3 billion increased 19% against 1H21, combined ROE of 16.9% (1H21: 15.4%), net interest margin of 416 bps (1H21: 403 bps), credit loss ratio of 77 bps (1H21: 84 bps), cost-to-income ratio of 54.1% (1H21: 55.9%).

South Africa began 2022 with momentum in trading conditions as the first quarter GDP figure reflected an economy that returned to pre-pandemic levels. This outcome was underpinned by the lifting of lockdown restrictions, strong terms of trade and high commodity prices. However, several adverse factors tempered that momentum during the first half of the year. These included the reintroduction of load shedding, flooding in KwaZulu-Natal – a province which includes sub-Saharan Africa’s biggest container port – increased labour action, elevated inflation levels globally and domestically, slow growth and significantly heightened geopolitical tensions.

Overall, the major banks navigated complex operating terrain in the first half of 2022. Rivaan Roopnarain, PwC Africa Banking and Capital Markets Partner, says: “Armed with important lessons learned through the volatile experience of the pandemic, and having refined overall bank strategies as a result, the major banks spent the first half of 2022 focused on the customer experience through continued digitisation and on driving the efficient execution of strategic priorities.”

Key themes observed from PwC’s Major Banks Analysis include:

– Resilient consumer and transactional activity, positive endowment effects of higher interest rates and balance sheet growth translated into strong revenue gains across retail, business and corporate banking franchises. At the same time, better than expected claims experience aided revenues from insurance activities – a strategically relevant and thematically growing part of the major banks’ revenue base.

– Combined headline earnings surpassed pre-pandemic levels, while balance sheet metrics remained robust. The major banks collectively now have more capital and risk provisions than ever before, which should help to shield against the effects of economic headwinds in the second half of 2022.

– Credit quality continued to improve as focus remained on disciplined origination, rigorous credit monitoring and strong collection strategies. Non-performing loan stock reduced marginally, while credit coverage ratios were maintained at prudent levels.

– Concentrated cost management efforts continued, with expense growth moderately above average CPI growth for the period. As we have previously observed, the configuration of the cost base continues to evolve in line with the major banks’ focus on digitally-led strategies. Productivity enhancements, digitisation and tight discretionary spend enabled the major banks to manage costs prudently in an elevated inflationary environment. This was offset by expense growth in certain areas coming off a low base, such as travel and marketing.

– Competition among the major banks remained intense, amplified by new entrants and niche lenders, with a distinct focus towards further building out Small Medium Enterprise and business banking strategies now increasingly evident. A recent joint report by the International Finance Corporation and World Bank estimated that “the unseen sector” comprising micro, small and medium enterprises constitutes more than 90% of all formal business in the country, employs 50-60% of the workforce and contributes 34% of GDP.

– Disciplined strategy execution continued, with key elements of management attention focused on digital channel innovation as customers now conduct a wider range of more routine banking and ancillary activities online. Meanwhile, branch interaction has increasingly become the domain of more personalised sales and servicing activities in areas such as home loans and wealth management. Other areas of strategic management focus during the period included further digitising IT estates and manual back office processes, limiting system downtime and relentlessly improving overall customer experiences.

– Hello again! In early April 2022 South Africa terminated its national “state of disaster” and lifted most of the mandatory lockdown measures put in place to curb the spread of COVID-19. This prompted a new wave of energy at corporate offices and other physical points of presence – including bank branches – as hybrid working practices become increasingly embedded.

– The trust imperative. The yardstick for measuring performance is expanding beyond financial metrics. The major banks increasingly recognise that fostering trust and transparency among stakeholders is a key strategic imperative and competitive differentiator. Simultaneously, international and domestic standard-setting bodies are shifting focus toward finalising a non-financial risk and sustainability reporting regime. While many details remain to be finalised, it’s clear that the future of corporate reporting will be broader, more complex and quite different from today.

– ESG opportunities. The intense stakeholder focus on more comprehensive sustainability reporting and ESG practices presents sources of strategic opportunities for the banking industry. From the provision of sustainability financing, arranging corporate debt placements of ‘green’ bonds to their own sustainability-linked issuances, we expect the major banks will play a key role in facilitating an orderly energy transition as economies, markets and companies adapt to evolving climate policy. The policy measures and actions set out in the presidential energy crisis plan in July are likely to trigger growing focus in this area.

– The risk outlook remains complex and evolving. From third and fourth party risk management, shoring up operational and cyber resilience to talent retention amidst increasing demand, the risk landscape points to several potentially overlapping challenges, as management teams take proactive steps to respond.

Major banks’ results highlights: PwC’s Major Banks Analysis highlights key themes from the combined local currency results of Absa, FirstRand, Nedbank and Standard Bank, and incorporates common strategic themes from other SA banks.

Costa Natsas, PwC Africa’s Financial Services Leader, says while the first half of 2022 remained challenging and uncertain for many South Africans, there were clear signs that the worst effects of the pandemic were now behind us. “What we observe in this set of results is evidence of the quality, strength and diversity of the major banks’ franchises, achieved against more buoyant indicators of consumer activity.”

– Headline earnings: Underpinned by strong transactional activity and revenue growth across product lines, industry sectors and banking franchises, combined headline earnings grew 19% against 1H21. Those banks with large regional presences outside South Africa saw the benefit of geographic diversification – with banking operations in key African markets benefitting from the higher rate environment, a recovery in international trade and strong growth in trading revenues. For some of the major banks, headline earnings reached record levels. Strong balance sheet resilience across key capital, liquidity and provisioning metrics remained a consistent theme for all of the major banks.

– Asset growth: Comparatively improved household balance sheets, better consumer and business confidence levels and pent-up demand from the worst phases of the pandemic produced strong credit growth, particularly in secured portfolios including vehicles and home loan financing. Overall, gross loans and advances grew by 9.8%.

– Liquidity and funding: On the back of higher interest rates and better household and business liquidity levels, demand for term and savings products helped total deposits grow 9.7%. The combined loan-to-deposit ratio remained flat at 87%, while liquidity prudential ratios continued to be managed well above regulatory required levels.

– Credit quality: Throughout the worst phases of the pandemic, the major banks bolstered their reputations as strong risk managers. That theme continued as they managed risks judiciously during the period, with a bias towards credit quality. The combined credit loss ratio (measured as the income statement impairment charge divided by average advances) fell by 7 bps to 77 bps (1H21: 84 bps). Total non-performing loans remained largely flat, comprising 4.6% of gross loans and advances (1H21: 5.2%), while provisions against these loans increased to 46.5% (1H21:43.8%).

– Costs: Combined operating expenses grew 8.2%, slightly above the 7.4% CPI recorded in June which represented a 13-year high in South Africa. While tight management of discretionary spend remains a focus area for management teams, the combination of staff costs, technology related spend and a rebound in travel and marketing contributed to the major banks’ cost base. Rising inflation has been experienced globally in recent months, driven by complex factors including supply chain disruptions exacerbated through the pandemic and the Russia/Ukraine conflict.

– ROE and capital: The combined regulatory capital of the major banks had already surpassed pre-pandemic levels in the previous reporting period. That theme continued in the first half of 2022. The total capital adequacy ratio amounted to 17.1% (1H21: 16.9%), providing the foundation for continued investments and supporting healthy dividend payout ratios in the period. The major banks’ ability to generate robust earnings while maintaining strong capital adequacy has long been a feature of the South African banking system. Combined ROE grew 150 bps to 16.9% (1H21: 15.4%).

Francois Prinsloo, PwC Africa’s Banking and Capital Markets Leader, says the major banks delivered robust results for the period on the back of focused execution of strategic priorities by management teams. “Supported by strong balance sheet metrics across capital, liquidity and credit provisioning, the major banks’ results reflect the benefits of underlying franchise momentum and management focus on strategy execution that is centred on enhancing customer experiences.”

Outlook: The outlook for the second half of 2022 is expected to be volatile and uncertain. Geopolitical risks remain tense and acute, and will add to supply chain pressures in the developed world. A dramatic rise in inflation coupled with recessionary risks across several economies is serving as the basis for the most rapid monetary policy tightening in decades. This fraught macroeconomic environment increases risk aversion in global financial markets and generates a material headwind for developing economies.

The International Monetary Fund forecasts 2022 global GDP growth of 3.2% and 3.8% in sub-Saharan Africa. African countries with elevated levels of dollar-denominated sovereign debt may face particularly challenging constraints. In South Africa, persistently high unemployment, the path towards a political elective conference in December and electricity supply constraints all serve as the backdrop for continued uncertainty.

Additionally, the country’s potential greylisting by the Financial Action Task Force (FATF) represents a worrying prospect. Implications of a greylisting are broad, including increased monitoring by FATF and more onerous reporting requirements by correspondent banks, possible restrictions on correspondent banking relationships and adverse impacts on funding costs. Unlike other sharp downside risks which are often rapid and unexpected, the possibility of FATF greylisting has been well documented. This has allowed the major banks to engage proactively with stakeholders, including with correspondent banks, to manage potential impacts.

Positively, the disciplined execution of structural reforms – including alleviating energy supply constraints, improvements in logistical infrastructure across freight rail and ports, and generally easing the administration of doing business – could add incrementally to South Africa’s GDP prospects.

While the fortunes of the banking industry and the broader economic environment are intertwined, several factors and actions taken by the major banks should help navigate the uncertainties ahead. These include the major banks’ strong brands, the bias towards prudence evident in credit provisioning and capital management, the positive endowment effect of higher interest rates, and overall balance sheet growth across loans and deposits which provides the basis for transactional revenues.

We expect the unrelenting focus on the customer experience through digital, product and channel innovation to continue. These themes are consistent with those observed in our recently issued global PwC report, “Retail Banking 2025 and Beyond”. Tech-powered transformation; data-enabled customer focus; and broad-based trust are becoming increasingly important. Similarly, integrating climate-related risks and leading ESG practices into lending policies and pricing strategies, existing enterprise risk management and external reporting frameworks will continue to demand management time over the medium term.