Adenia Capital sells African payments industry player to SPE Capital

The sale of OMOA is the eighth and final exit from Adenia’s €96 million Adenia Capital III fund.

** For the best experience, download the free Africa Private Equity News app Android | iOS **

Private equity firm Adenia has finalised the sale of its 100% equity stake in OMOA Group to SPE Capital, a private equity firm focused on the Middle East and Africa.

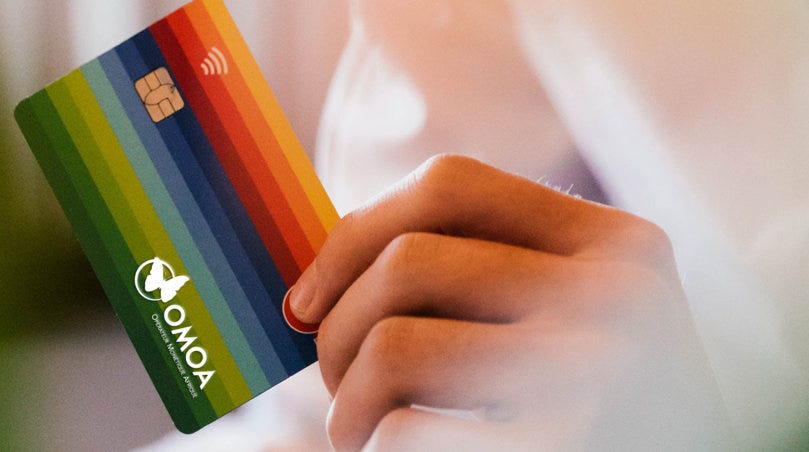

Founded in 1999, OMOA is an integrated service provider for the payments industry in West and Central Francophone Africa. The sale of OMOA is the eighth and final exit from Adenia’s €96 million Adenia Capital III fund, which is now fully liquidated.

OMOA provides a comprehensive range of services throughout the payment value chain, including ATM installation, ATM maintenance and software solutions, as well as processing and card personalisation. OMOA serves a wide range of banks and microfinance institutions across 11 countries, employing 150 people.

Since acquiring OMOA in 2012, Adenia has implemented a series of strategic value creation initiatives to transition OMOA’s business model towards more value-added services. This included the upgrade of its ATM offering, the development of new maintenance capabilities and the establishment of a unique processing and card personalisation centre in Lomé, Togo. Adenia also recruited a new senior management team to support this growth strategy, institutionalise the company’s governance, strengthen its processes and implement its ESG action plan.

“Today, OMOA benefits from strong recognition across its markets, not only as an ATM distributor, but as a strong strategic partner for banks through the provision of tailor-made solutions across the entire payment value chain,” said Christophe Scalbert, partner at Adenia. “We are confident that SPE will provide valuable support for OMOA’s talented teams as the company enters the next phase of its growth. We are also thrilled to complete the final exit from our third fund.”

“This is the first investment from our newly raised private equity fund, SPE PEF III, LP, and we are looking forward to contributing to further enhance OMOA’s leadership position in the region and execute on its transformational growth plans,” said Stéphane Heuzé, managing partner at SPE.

Adenia Partners was advised by Lazard (financial advisor), Asafo & Co (legal lead advisor), Deloitte (financial and tax advisors), Edgar, Dunn & Company (strategic advisor), CMS Francis Lefebvre (legal and tax advisor).

SPE Capital was advised by DLA Piper (legal lead advisor), FIME (strategic advisor), KPMG (financial and tax advisors), IBIS (ESG advisor), Deloitte (BI advisor), and AXA Climate (climate advisor).

Stay ahead in Africa's private equity and venture capital sector with Africa Private Equity News’ monthly Dealmaker’s Log – a database of reported investment deals, exits, and fundraising closes. Subscribe here