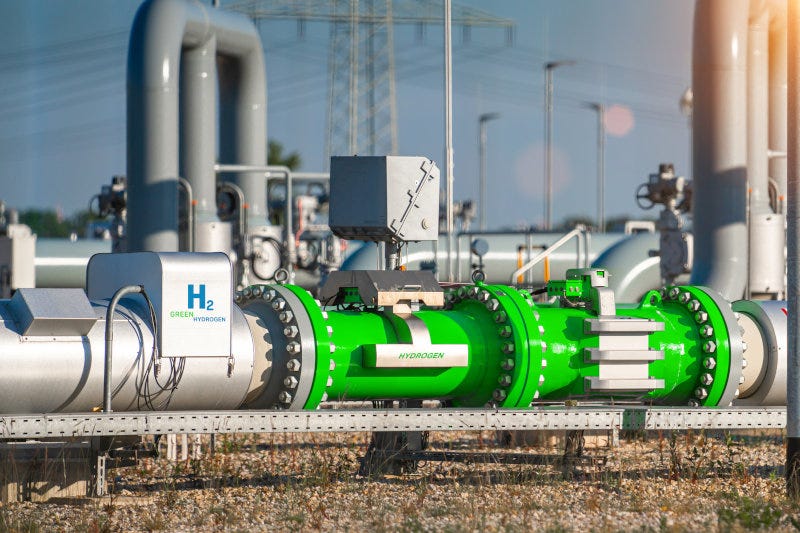

Copenhagen IP and A.P. Møller Capital back Morocco green hydrogen project

Chbika project to supply clean energy to Europe.

** For the best experience, download the free Africa Private Equity News app Android | iOS **

TE H2, a joint venture between TotalEnergies and the EREN Group, along with its partners, Copenhagen Infrastructure Partners (CIP) and A.P. Møller Capital, have signed a preliminary land reservation agreement for the Chbika project in Morocco's Guelmim-Oued Noun region, marking a significant step toward green hydrogen production. This agreement will enable the launch of pre-FEED (preliminary front-end engineering and design) studies.

Both CIP, through its Energy Transition Fund, and A.P. Møller Capital, via its Emerging Markets Infrastructure Fund, play a central role in this project, which plans to establish 1 GW of onshore solar and wind capacities that will power the production of green hydrogen through the electrolysis of desalinated seawater and its transformation into 200,000 tonnes per year of green ammonia for the European market.

TE H2 and CIP will be responsible for the development of renewable energy production (solar, wind, green hydrogen, and its derivatives), while A.P. Møller Capital will develop the port and associated infrastructure.

Patrick Pouyanné, chairman and CEO of TotalEnergies, stated: “I would like to thank the Moroccan authorities for awarding the Chbika project and for the trust they have shown in our subsidiary TE H2 and our partners. This agreement is part of our strategy to develop production in countries with the most competitive renewable resources, such as Morocco. Thanks to its geographical proximity and the quality of its wind and solar resources, Morocco indeed has the best assets to become a major partner for Europe in achieving the goals of the Green Deal, and TotalEnergies aims to contribute to this ambition.”

David Corchia, CEO of TE H2, added: “The signing of this preliminary contract for land reservation is a decisive first step for the launch of our investment programme in Morocco. It demonstrates our commitment to developing green hydrogen initiatives that support the country’s energy transition, industrialisation and job creation. The Kingdom has the potential to supply affordable and clean energy to Europe while serving its own decarbonised industrial development. Our consortium is strong, our overall Moroccan plan is very ambitious, and I look forward to reinforcing further our collaboration with local authorities and stakeholders and pursuing the work on this promising project.”

Philip Christiani, partner at CIP, commented: “Morocco stands at the forefront of the global energy transition equipped with all the essential fundamentals to emerge as a key partner for Europe and the world in achieving net zero targets. At Copenhagen Infrastructure Partners, we’re extremely proud to be a part of this initiative with TE H2 and A.P. Møller Capital and to be selected for the development of the first green hydrogen project under the ‘Offre Maroc’ framework.”

Kim Fejfer, CEO of A.P. Møller Capital, stated: “We are proud to take this important step in the development of the green hydrogen industry in Morocco, building on the A.P. Møller Group’s long-standing history with the country. Developing competitive transport infrastructure is part of what we do and a fundamental part of green hydrogen value chains. We are looking forward to bringing this project forward in close collaboration with our strong consortium, Moroccan authorities and other stakeholders.”

Stay ahead in Africa’s private equity and venture capital sector with Africa Private Equity News’ monthly Dealmaker’s Log – a database of reported investment deals, exits, and fundraising closes. Subscribe here