Enko Capital hits $100m first close for Africa credit fund

Fund backed by BII and IFC to provide dollar loans to mid-sized businesses.

For the best experience, download the free Africa Private Equity News app Android | iOS **

Enko Capital, the Africa-focused alternative asset manager, has reached the first close of its Enko Impact Credit Fund, raising $100 million toward a $150 million target.

Investors in the first close include British International Investment (BII), the International Finance Corporation (IFC), SICOM Global Fund, and other asset managers, African pension funds, and family offices.

The fund provides US dollar-denominated private credit to mid-market companies across sub-Saharan Africa, focusing on established, cash-generating businesses in non-cyclical sectors such as agriculture, telecommunications, manufacturing, renewable energy, and financial services.

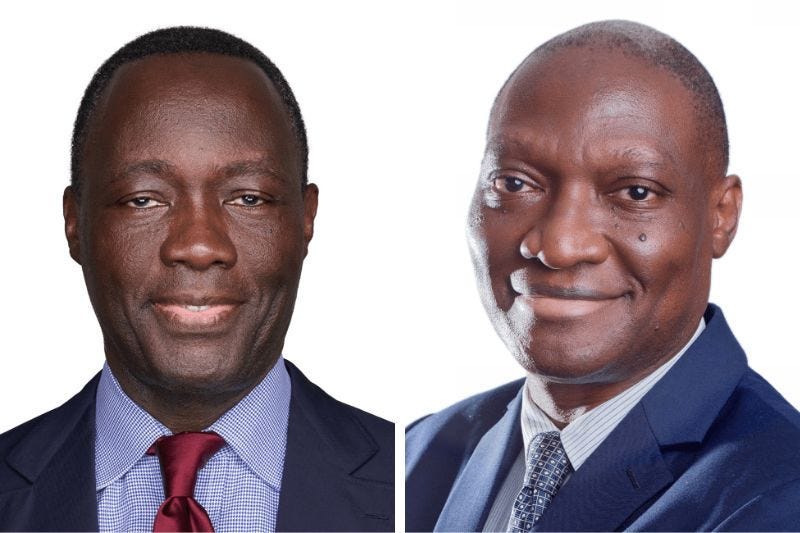

Alain Nkontchou, managing partner of Enko Capital, said: “The successful first close of Enko’s flagship private credit strategy underscores growing investor confidence in Africa’s sustainable development through private credit.”

Leslie Maasdorp, chief executive officer at BII, commented: “Our commitment to the Enko Impact Credit Fund reflects BII’s belief in the commercial potential of private credit in Africa and its role in closing the financing gap for mid-sized businesses. By anchoring the fund’s first close, our aim is to send a strong signal to other investors, attract additional capital and help build a viable private credit market that supports businesses critical to economic growth in Africa.”

Mohamed Gouled, vice president for industries at the IFC, added: “Expanding access to finance for mid-sized companies is critical to accelerating inclusive growth across Africa. IFC’s support for the Enko Impact Credit Fund demonstrates IFC’s commitment to channelling longer tenor and flexible funding to African businesses for growth and job creation. Through this partnership, we will support businesses across a range of sectors, from agribusiness to telecoms, that are critical for sustained economic growth.”

Want to know who is raising, investing, and exiting in Africa? Get Africa Private Equity News’ monthly Dealmaker’s Log – a database of reported investment deals, exits, and fundraising closes. Subscribe now