IFC proposes commitment to Enko Capital fund

The Enko Impact Credit Fund is targeting gross US dollar returns of 14–16%.

** For the best experience, download the free Africa Private Equity News app Android | iOS **

The International Finance Corporation has disclosed a proposed investment of up to $25 million or 20% of total LP commitments, whichever is lower, in the Enko Impact Credit Fund (EICF).

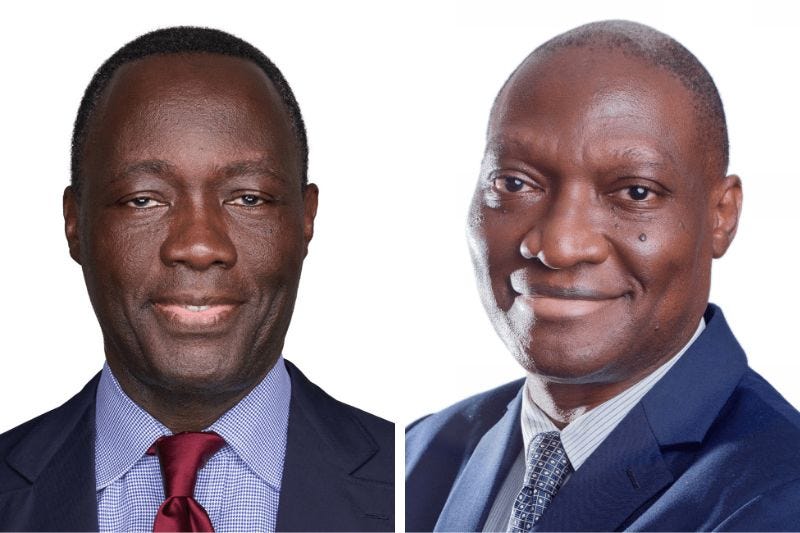

The fund will be managed by Enko Capital, an Africa-focused asset manager with debt and equity investments across the continent. The firm was founded by two brothers, Alain and Cyrille Nkontchou.

The fund is targeting a total size of $150 million, with a first close of $80 million expected in the third quarter of 2025. It aims to invest in a diversified portfolio of US dollar-denominated senior secured and unsecured debt issued by mid-sized corporates in sub-Saharan Africa, excluding South Africa.

EICF is targeting gross US dollar returns of 14–16%, comprising cash coupons of 9–11%, with the remainder expected to come from embedded upside structures.

The fund is expected to invest in around 10 companies across multiple sub-Saharan African countries.

Stay ahead in Africa's private equity and venture capital sector with Africa Private Equity News’ monthly Dealmaker’s Log – a database of reported investment deals, exits, and fundraising closes. Subscribe here