Mauritius: A hub for your trading operations

Have you considered using Mauritius for your trading operations?

Africa Private Equity News’ Connect messaging service is now free. Directly message other private equity professionals in our community.

Download the free Africa Private Equity News app: Android | iOS (or search for it in the app store)

Tap on the top-right icon to log in or register a free account

Tap on bottom-right Connect icon to start chatting

Have you considered using Mauritius for your trading operations?

Over the past decades, Mauritius has consolidated its position as a preferred jurisdiction for the structuring of global companies involved in multinational trading operations.

Other than the protective legal and regulatory environment, Mauritius has been able to provide a favourable tax regime with an effective tax rate of up to 3% on trading profits – irrespective of whether the traded products are transited through Mauritius or not.

Do you wish to learn more about using Mauritius as a platform for your trading activities?

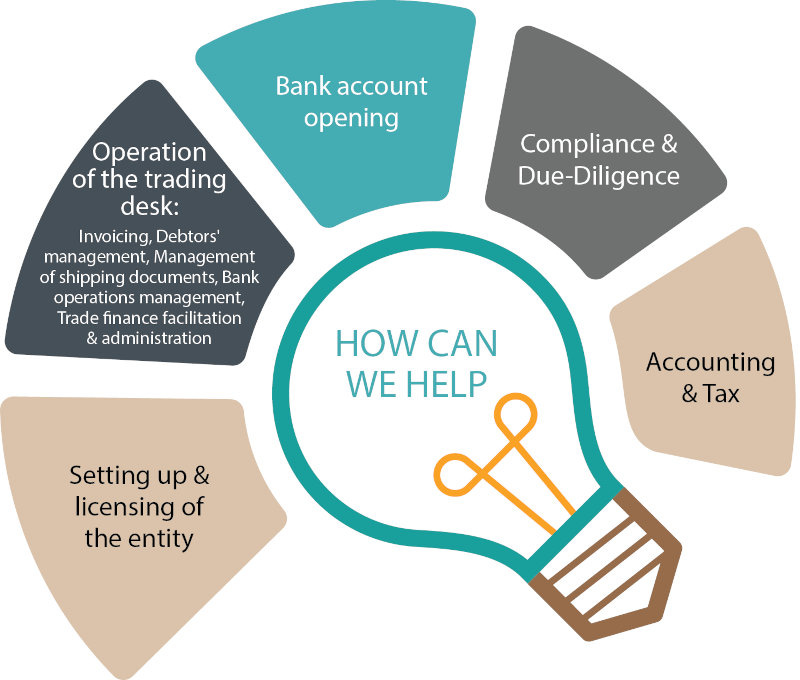

How can ITL help you?

We leverage our robust foundation, agility and widespread network of collaborators to help you with:

Established in 1999, Intercontinental Trust Limited (ITL) provides a plethora of financial and fiduciary services to a diversified client base including private equity firms, real estate multinationals, financial institutions, investment managers and high-net-worth individuals among others.

ITL is located in Ebene, the financial centre of Mauritius and has offices in Singapore, Seychelles and representative offices in South Africa and Kenya.