Namibia: Climate Fund Managers backs green ammonia project

The SDG Namibia One Fund announced the signing of a development funding agreement to advance the Zhero Molecules Walvis Bay Project.

** For the best experience, download the free Africa Private Equity News app Android | iOS **

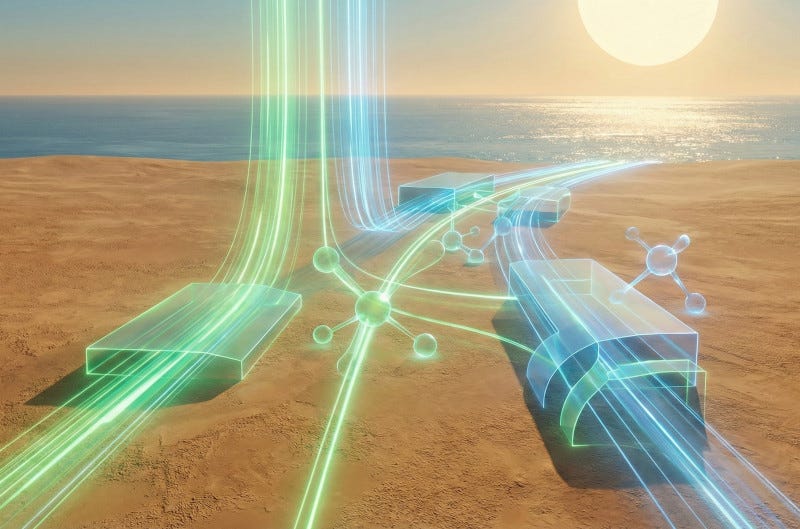

The SDG Namibia One Fund, managed by Climate Fund Managers, announced the signing of a development funding agreement with Zhero Europe, to advance the Zhero Molecules Walvis Bay Project, an industrial-scale green ammonia facility. The fund has committed up to $5.15 million to enable Zhero to complete the development and feasibility activities required to progress the project toward a final investment decision, targeted for 2027. Commercial operation is expected in 2030.

Darron Johnson, regional head for Africa at Climate Fund Managers, said: “Zhero’s project aligns strongly with Namibia’s ambition to build a competitive green hydrogen and ammonia industry, as well as with the mandate of our SDG Namibia One Fund. The site benefits from exceptional solar resources, ample land and direct access to deep-water export infrastructure at Walvis Bay, making it well-suited for industrial-scale green ammonia production. Through its blended finance structure, SDG Namibia One is providing early-stage development capital alongside Zhero needed to de-risk the project and prepare it for financial close, creating the conditions for private capital to invest at scale in the construction phase. We look forward to working with Zhero to bring this important project from development, through construction and into operation.”

Paolo Gallieri, chief operating officer at Zhero commented: “This development funding from SDG Namibia One will be additive to our own development funding investment. Given the deep understanding of the Namibian ecosystem that the team at the Fund bring and the blended-finance model they can augment, we very much regard this investment as pivotal to the success of this venture. Namibia has the natural resources, strategic location and national vision to become a global leader in green ammonia and hydrogen. With this support, we are strengthening our ability to deliver a world-class facility that can attract long-term investment, create economic opportunities for the country and contribute to global decarbonisation efforts.”

Want to know who is raising, investing, and exiting in Africa? Get Africa Private Equity News’ monthly Dealmaker’s Log – a database of reported investment deals, exits, and fundraising closes. Subscribe now