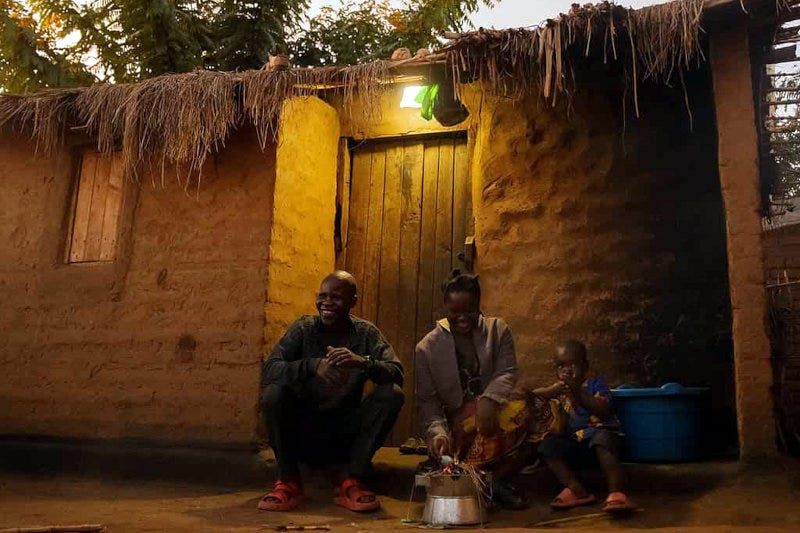

New facility to finance off-grid energy solutions in Mozambique

The facility will finance the receivables of companies distributing off-grid energy solutions in Mozambique.

** For the best experience, download the free Africa Private Equity News app Android | iOS **

Investment company Mirova has partnered with Bridgin, a platform that connects distributors' loan management platforms with investors, and technology company Hypoport Africa to establish a facility that will finance the receivables of companies distributing off-grid energy solutions in Mozambique through pay-as-you-go models.

Acumen through its Hardest-to-Reach initiative will be supporting with technical assistance to finance the structuring of the facility.

Pay-as-you-go companies often struggle to secure financing that aligns with their unique needs. Smaller distributors are typically overlooked by capital providers due to the small ticket sizes they need, which are seen as costly and complex to manage. Existing funding structures, such as loans or equity, are generally provided in large sums and do not accommodate the incremental funding requirements of pay-as-you-go organisations that need to finance both their inventory needs and the credit they extend to customers. Additionally, most of the financing is in USD, though local currency financing would better support their long-term stability.

The new facility seeks to solve these challenges by aggregating receivables, allowing last mile distributors (LMDs) to access affordable capital. This will enable companies to expand their portfolios without constantly needing to raise new funds. The facility aims to offer $20 million, potentially issued in local currency, in a structure closely aligned to the operational needs of LMDs.

“We are excited to contribute to this collaborative step towards accessible financing for Mozambique’s energy distributors. By creating accessible financing pathways, we’re setting the stage for a scalable, long-term impact on energy access in underserved communities,” said Manon Dubois, fintech business lead from Bridgin.

“Great to experience the commitment to bring the African off-grid energy paygo market ready to invest for more institutional end investors,” commented Peter van der Linde from Hypoport Africa.

“Mirova UK is excited to be supporting this innovative initiative in Mozambique that aims to bridge the financing gap for last mile distributors of solar home systems and productive use equipment,” said Nicole Kugelmass, managing director form Impact Finance Services.

“Acumen’s Hardest-to-Reach is thrilled about funding this innovative initiative that has the potential to create a more vibrant energy market for underserved communities,” commented Sandra Halilovic, head of Acumen’s Hardest-to-Reach development facility.

Stay ahead in Africa's private equity and venture capital sector with Africa Private Equity News’ monthly Dealmaker’s Log – a database of reported investment deals, exits, and fundraising closes. Subscribe here