PwC: South Africa Major Banks Analysis

South Africa’s major banks demonstrate a durable financial performance in the first half of 2024.

By PwC

South Africa’s major banks demonstrate a durable financial performance in the first half of 2024 against complex operating conditions and elevated levels of uncertainty.

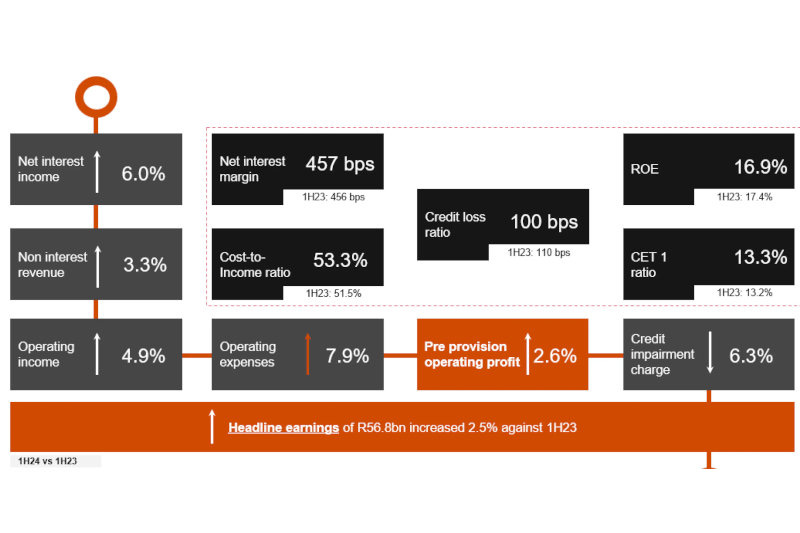

Combined headline earnings growth of 2.5% against 1H23 to R56.8bn, combined ROE of 16.9% (1H23: 17.4%), net interest margin of 457 bps (1H23: 456 bps), credit loss ratio of 100 bps (1H23: 110 bps), cost-to-income ratio of 53.3% (1H23: 51.5%), common equity tier ratio of 13.3% (1H23: 13.2%)

The start of 2024 was characterised by acute levels of uncertainty as nearly half the global population entered an election year. Globally, inflation remained sticky and slowed the anticipated pace of interest rate cuts. Regionally, several sub-Saharan African countries felt the combined impacts of socio-economic events, a complex El Nino weather pattern, subdued commodity prices and elevated debt levels – against the backdrop of sustained inflationary pressures and currency weakness in some territories. In South Africa, notable improvements in structural constraints, including electricity supply, and generally positive market reaction to the formation of a Government of National Unity, were reflected in lower government debt costs and a stronger Rand. However, flat SA GDP growth in the first quarter of 2024 revealed muted household demand and businesses under pressure, marginally offset by second quarter GDP growth of 0.4%.

“Within an environment shaped by complex macroeconomic conditions and elevated levels of uncertainty, South Africa’s major banks continue to demonstrate the durability of their businesses. These results reflect a deep and continuing commitment to executing on their strategies with precision and adaptability, while maintaining focus on enhanced customer experiences and leveraging the strength of their franchises to build trust through financial services,” says Rivaan Roopnarain, PwC South Africa Banking and Capital Markets Partner.

Key themes observed from PwC’s Major Banks Analysis include:

Measured balance sheet growth across lending and deposit taking activities continued to provide the foundation for the major banks to do more with customers. Accordingly, earnings in 1H24 was supported by resilient revenue growth across both interest income and non interest revenue, aided by improved credit trends relative to recent periods.

Intense strategic focus on the rest of Africa outside South Africa continues to provide strong levels of diversity to overall performance. The scale and competitiveness of operations in high growth African markets – and their earnings contributions – has emerged as a clear area of distinction for many of the major banks. However, balancing market specific and sovereign risks with group-wide efficiencies was complicated in this period due to significant factors such as increased cash reserving requirements and currency volatility in certain key territories. This currency volatility resulted in the major banks’ combined foreign currency translation reserves reaching record levels, depressing group results.

The consistent theme of the major banks’ robust resilience metrics continued, with strong capital and liquidity levels and risk coverage. Regulatory requirements in respect of capital and liquidity remain comfortably maintained, while model-driven balance sheet provisions responded to credit risks in specific geographies, sectors and portfolios.

Moderated impairment charges, particularly in South African retail lending portfolios, drove down the combined credit loss ratio to 100 bps (1H23: 110 bps). Improved credit trends in South Africa were supported by slower inflows into early arrears as a result of proactive customer assistance programmes and enhanced collection processes implemented by the major banks. However, higher impairments were generally evident within corporate lending portfolios driven by counterparty and industry specific risks and, in a continuation from our previous observations, within sovereign asset portfolios beyond South Africa given the fiscal issues facing several African countries. On a combined average basis, the major banks’ credit loss ratio remains at the upper end of their average “through-the-cycle” range.

The major banks’ combined strategic target of a 50% cost-to-income ratio was challenged in the current period by elevated inflation levels and volatile exchange rates. With a continued focus on disciplined cost management evident in this results period, the major banks’ cost base remains reflective of investments in talent, technology and the corporate brand through marketing and sponsorships. Concurrently, strategic priorities in software spend and cloud and technology-related costs reflect contractual increases and subscription costs, which are often foreign denominated.

The migration of customers to digital banking platforms and channels, while leveraging data as a strategic asset, has moved from theme to certainty. South Africa’s major banks have now consistently grown the number of digitally active clients every reporting period since 2H19 to approximately 20 million. The optimal combination of digitally charged businesses, with complementary physical presence, remains a focus area for management teams, driven by the need to keep pace with customer expectations and accelerate transaction processing.

Closely watched non-financial banking industry trends are coalescing around the fast moving areas of technology change, including the impact of generative AI, and climate transition. Bank management teams continue to view these areas as presenting both opportunities and risks, while aware of the need to customise for the context of the local environments in which they operate. Increasingly, the major banks’ sustainable financing targets and reporting against them are becoming more clearly calibrated and prominent.

While prospects for the rest of 2024 remain complex and subject to significant uncertainty, consensus expectations for interest rate cuts across several territories provides a basis for optimism. Globally, economic sentiment is likely to be consequentially influenced by the combination of the US election, inflationary readings and tense geopolitics. However, the major banks’ GDP growth expectations in both SA and various other African presence countries remain cautiously optimistic, which will influence their scenario planning and the positioning of their balance sheets in response to developments in the operating environment.

Major banks’ results highlights: PwC’s Major Banks Analysis highlights key themes from the combined local currency results of Absa, FirstRand, Nedbank and Standard Bank, and provides reflections from the common strategic themes within the other South African banks.

“What we note in these results is the continued characteristics of South Africa’s major banks being well diversified, resilient and able to unlock growth. Despite complexities and uncertainties that are anticipated for the rest of 2024, we expect that the major banks will remain focused on supporting clients, managing risk, leveraging technology and developing talent—aligned to their strategic visions,” says Costa Natsas, PwC Africa’s Financial Services Leader.

Headline earnings: The major banks’ aggregate headline earnings growth of 2.5% against 1H23 to R56.8bn reflects the combination of resilient revenue growth across net interest income (6%) and non-interest revenue (3.3%), supported by a decline in credit impairment charges of 6.3%. Despite robust underlying franchise momentum and strong operating performances outside South Africa, headline earnings growth was impacted by significant foreign currency weakness in some territories.

Loan growth: Reflecting the challenging operating conditions that prevailed over 1H24, coupled with depressed consumer and business confidence, new loan formation was muted. Combined gross loans and advances grew 3.7% against 1H23 (1.7% against 2H23). Similar to previous periods, growth in individual loan portfolios and industry sectors was differentiated between the major banks, based on a combination of strategic focus, geographic footprint and risk appetite. According to Bureau information from the National Credit Regulator (NCR), the number of credit-active South African consumers increased by 464,009 quarter-on-quarter and 854,191 year-on-year to 27.9 million.

Credit quality: We have previously commented on the link between interest rates and impairments – as customer loan portfolios bearing the brunt of elevated interest rates eventually manifest into higher impairments. While this context remained applicable, in 1H24 the major banks benefited from provision releases following the successful restructure of legacy corporate non-performing loans, the non-recurrence of prior period sovereign credit risk charges and a slowdown into early arrears and default in South African retail portfolios on the back of close monitoring and targeted collection initiatives. The combined credit loss ratio (the income statement impairment charge divided by average advances) moderated to 100 bps (1H23: 110 bps) as the income statement credit risk charge decreased 6.3% (from R28.9 billion in 1H23 to R27.1 billion in 1H24). Total non-performing loans increased 8.1% against 1H23, comprising 5.5% of gross loans and advances (1H23: 5.2%). According to the NCR Bureau information referenced above, the number of South African consumers with impaired records in Q1-24 increased by 190,428 to 10.1 million, an increase of 1.9% quarter-on-quarter and 2.7% year-on-year.

Costs: As Stats SA notes, “after holding steady for ten months in the 5–6% range, annual consumer price inflation slowed to 4.6% in July from 5.1% in June.” Outside SA, elevated inflation readings were thematic across several key territories in which the major banks operate. Against this elevated inflationary context, disciplined cost control remained a key focus for the major banks’ management teams in 1H24. Key cost drivers were largely aligned to strategic focus areas, including cloud-based software and security costs, continued investments in technology and the corporate brand, while currency weaknesses in African markets outside South Africa counterbalanced ZAR-based cost growth. Overall, the pace of cost growth (7.1%) exceeded revenue growth (4.9%), resulting in the aggregate cost-to-income ratio expanding to 53.3% (1H23: 51.5%).

ROE and capital: Impacted by the volatile currency effects of translating foreign operations, the major banks’ combined ROE fell 47 bps to 16.9% (1H23: 17.4%), still above their average cost of equity of 15%. Although the combined common equity tier 1 capital ratio moderately increased to 13.3% (1H23: 13.2%), the major banks have all commented on their comfortable levels of capitalisation to support opportunities, risks and stakeholder expectations.

“Notwithstanding difficult operating conditions, South Africa’s major banks steered through the first half of 2024 with purposeful resilience. These commendable results reflect the quality of leadership teams and talent resident within the South African banking industry as they manage the twin priorities of dealing with present conditions while anticipating pivotal trends, and positioning their businesses accordingly,” says Francois Prinsloo, PwC Africa’s Banking and Capital Markets Leader.

Outlook: As anticipated, 2024 has so far met expectations of being a year emblematic of considerable complexity, uncertainty and forecast risk—themes we expect to hold for the rest of the year.

Unresolved conflicts in Eastern Europe and the Middle East continue to elevate regional and global geopolitical tensions and complicate the macroeconomic outlook. Meanwhile, elections in the US in the second half of 2024—together with key African countries including Mozambique, Ghana and Namibia—add further elements of unpredictability to the outlook.

Overall, the International Monetary Fund forecasts global growth of 3.2% for 2024, with emerging market and developing economies expected to grow by 4.3% in both 2024 and 2025. In aggregate, the major banks forecast South African GDP growth of 1% in 2024, with potential for material upside depending on the path and progress of structural reforms. While growth expectations for sub-Saharan Africa remain more favourable than South Africa, adverse weather-related incidents remain a material forecast concern.

Positively, consensus around the global, regional and local inflation outlook has improved, with expectations for monetary policy action to reduce interest rates – albeit at a modest and measured pace – widely expected to commence in September.

Overall, the major banks have noted their focus remains on executing their carefully calibrated bank strategies which include their African operations outside SA, unlocking efficiencies, further enhancing customer experiences and leveraging their balance sheets to support sustainable financing in localised contexts.

Replicating the operating momentum of a strong 2023 and a resilient performance in the first half of 2024 will remain front and centre for management teams amidst acute levels of uncertainty.