South Africa: Hlayisani Capital backs Spatialedge

Spatialedge has closed R60 million (c. $3.1 million) in funding from Hlayisani Capital.

Africa Private Equity News’ Connect messaging service is now free. Directly message other private equity professionals in our community.

Download the free Africa Private Equity News app: Android | iOS (or search for it in the app store)

Tap on the top-right icon to log in or register a free account

Tap on bottom-right Connect icon to start chatting

Data and applied AI solutions company, Spatialedge, has announced the closing of R60 million (c. $3.1 million) in funding from Hlayisani Capital, marking a significant milestone in its mission to transform the retail industry.

This South African advanced technology business started in 2017, and currently operates out of Stellenbosch. It enables companies to rapidly build and operationalise robust machine learning solutions.

The company has experienced rapid growth, surpassing R300 million (c. $15.6 million) in revenue, and has established a track record with many of Africa’s largest multinational enterprises.

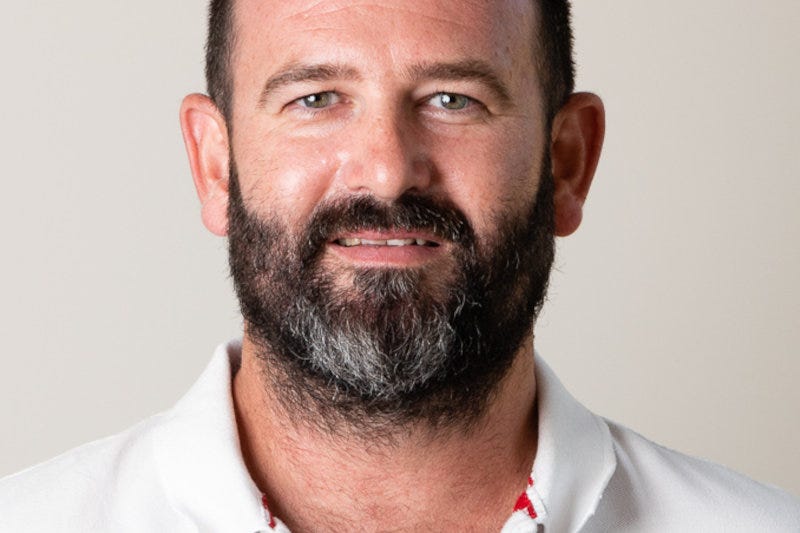

“We have worked directly with our customers for seven years, researching, developing and delivering cutting-edge, tailored solutions that solve real-world business problems,” says Retief Gerber, CEO of Spatialedge. “With this recent investment boost, we are now able to accelerate the process of releasing these solutions into the market and make them accessible to more customers.”

According to Gerber, the fresh capital will enable the business to expand its research and development efforts, and enhance its product line-up.

“Our portfolio of products is years in the making and has been meticulously crafted and refined through extensive real-world application,” states Gerber. “This hands-on experience has not only proven the effectiveness of our technologies but has also allowed for continuous improvement based on direct feedback and ever-evolving market needs.”

According to Gerber, the progressive AI solutions developed by the business are all focused on optimising operational decision-making in enterprise. These include optimal pricing of retail products, capital allocation, labour scheduling, markdown optimisation and much more.

One such testament to Spatialedge's impact comes from the Pepkor group.

Jason Peisl, group CIO at Pepkor shared, “Pepkor has been investing in advanced analytics and AI solutions since 2017 and have seen significant improvements across supply chain, logistics, pricing, expansion and marketing. Spatialedge has been a crucial part of our analytics and AI journey. We are excited to continue our partnership with Spatialedge and leverage the acceleration that their technology and services enable. Effective AI is becoming a critical component of business success and we strive to continue to be the AI leaders in retail.”

Hlayisani Capital is a South African venture capital and private equity firm focused on investing in high-growth, high-impact African technology companies. Hlayisani’s latest fund, the Hlayisani Venture Fund II, is not aimed at startups, but rather at growth-stage firms that have proven their business model and are looking to expand locally and internationally.

Spatialedge is the second investment made by the R700 million (c. $36.4 million) Hlayisani Venture Fund II, which reached first close in Q1 of 2023.

Mathew Palin, partner at Hlayisani Capital, remarked, “Spatialedge exemplifies the type of forward-thinking and impactful companies we aim to support with the Hlayisani Venture Fund II. Their proven track record with major brands and commitment to advancing the big data and AI landscape aligns perfectly with our investment philosophy. We are confident Spatialedge is well-positioned to continue to have a significant impact in the industry. We look forward to supporting them on their journey and helping them reach new heights.”

* Subscribe to Africa Private Equity News’ monthly Dealmaker’s Log for a database of the reported investment deals, exits and fundraising closes. Click here for more information.