The 5 most popular stories on Africa Private Equity News this week

Here are summaries of the five most widely read stories this week on Africa Private Equity News.

Africa Private Equity News’ Connect messaging service is now free. Directly message other private equity professionals in our community.

Download the free Africa Private Equity News app: Android | iOS (or search for it in the app store)

Tap on the top-right icon to log in or register a free account

Tap on bottom-right Connect icon to start chatting

Here are summaries of the five most widely read stories this week on Africa Private Equity News.

1. XSML Capital announces first close of fourth fund

XSML Capital, a provider of growth capital to SMEs in Central and Eastern Africa, has launched its fourth fund, African Rivers Fund IV, with a first close of $98.7 million. The new funding allows XSML to double its investments and impact over the coming years and follow investees into new markets like Zambia.

Existing investors in previous funds reinvested and increased their commitment with some doubling their exposure. One new investor joined. Read the full article

2. Adenia to acquire 12 Air Liquide subsidiaries in Africa

Adenia Partners has signed an agreement with Air Liquide, a supplier of industrial and medical gases, for the acquisition of 12 of its subsidiaries in West and Central Africa and the Indian Ocean.

As part of the agreement, the entities and employees in Benin, Burkina Faso, Cameroon, Congo, Côte d’Ivoire, Gabon, Ghana, Madagascar, Mali, Democratic Republic of Congo, Senegal and Togo will form a new, independent, pan-African industrial gases group, that Adenia intends to strengthen and develop through long-term support and additional investments of up to €30 million. Read the full article

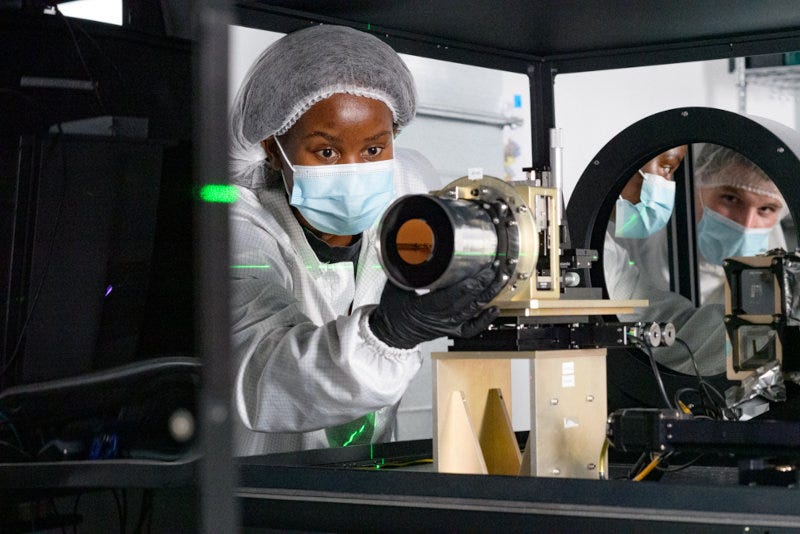

3. Knife Capital backs Earth observation optical imaging solutions company

Simera Sense, a provider of end-to-end optical solutions for the small satellite Earth observation industry, has raised €13.5 million from Knife Capital and NewSpace Capital. The company was launched in South Africa and is now headquartered in Belgium.

The company, which offers a diverse array of ‘off-the-shelf’ high-resolution cameras ready for use by clients across the global small satellite industry, has grown rapidly since its founding in 2018. Simera supplies solutions to global customers in the Earth observation data and service market, which is estimated to be worth $12.55 billion in 2024, and is expected to reach $20.73 billion by 2029. Read the full article

4. RMB Ventures and Bopa Moruo acquire majority stake in Icon Oncology

RMB Ventures and Bopa Moruo Private Equity, alongside management, have acquired a majority stake in Icon Oncology Holdings, which is a provider of cancer treatment in South Africa. Since inception, Icon and its subsidiaries Icon Radiotherapy, Icon Chemotherapy and Icon Managed Care have pioneered the move to value-based care in cancer treatment in South Africa.

Icon has a national footprint of 26 radiotherapy facilities incorporating 30 state-of-the-art linear accelerators. The business employs more than 300 clinical professionals who deliver care to approximately 30,000 patients annually. In addition to 59 accredited chemotherapy units, Icon manages three compounding pharmacies and a licensed pharmaceutical wholesaler. The Group also owns 16 specialised properties incorporating the bunkers from which it operates. Read the full article

5. Egypt: Upturn Ventures backs adtech company

Egypt-based street-level adtech company dKilo has secured $3.2 million seed funding, in a mix of equity and debt, from Upturn Ventures.

The partnership aspires to transform the way brands connect with audiences beyond the traditional digital space, which unlocks new means for e-commerce businesses to increase their awareness and conversions. Read the full article

* Subscribe to Africa Private Equity News’ monthly Dealmaker’s Log for a database of the reported investment deals, exits and fundraising closes. Click here for more information.